- Home >

- News & Media > Annual Victorian self-driving & electric car survey: trends, preferences and perceptions

Annual Victorian self-driving & electric car survey: trends, preferences and perceptions

In late 2023, EastLink conducted its seventh Annual Victorian Self-Driving & Electric Car Survey, gathering insights from over 4,500 motorists who use Melbourne's EastLink.

This comprehensive annual survey, the largest of its kind, sheds light on evolving vehicle power preferences, barriers to electric vehicle (EV) adoption, and perceptions of self-driving technology.

Such insights are useful to automotive manufacturers, policymakers, researchers and others. Understanding motorists’ attitudes can help with addressing their concerns and improving the user experience with new technologies.

Shifts in Vehicle Power Preferences

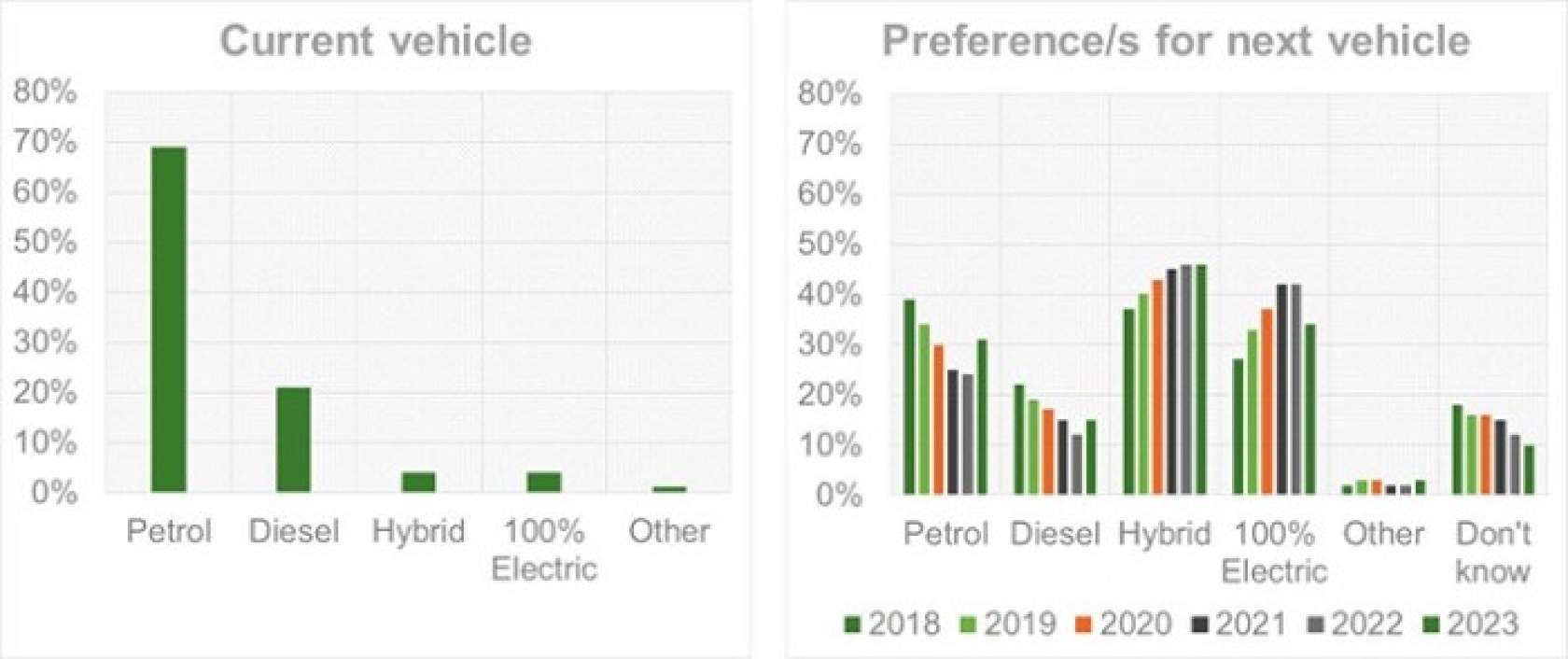

Hybrid Electric Vehicles: Remain popular, with 46% of motorists including hybrid in their power preferences for their next vehicle.

100% Electric Vehicles: Preference for fully electric vehicles has dropped significantly to 34%, down from 42% in the previous two years.

Petrol and Diesel Vehicles: Preferences have increased, with petrol rising from 24% to 31% and diesel from 12% to 15%. This is the first EastLink annual survey to show preferences for 100% electric vehicles have decreased while petrol and diesel preferences have increased.

Short-term vs. Long-term Preferences: While hybrid vehicles continue to be favoured for purchases in the short-term, hybrid also now surpasses fully electric for vehicles expected to be bought beyond five years, a notable shift from previous years.

Barriers to Electric Vehicle Adoption

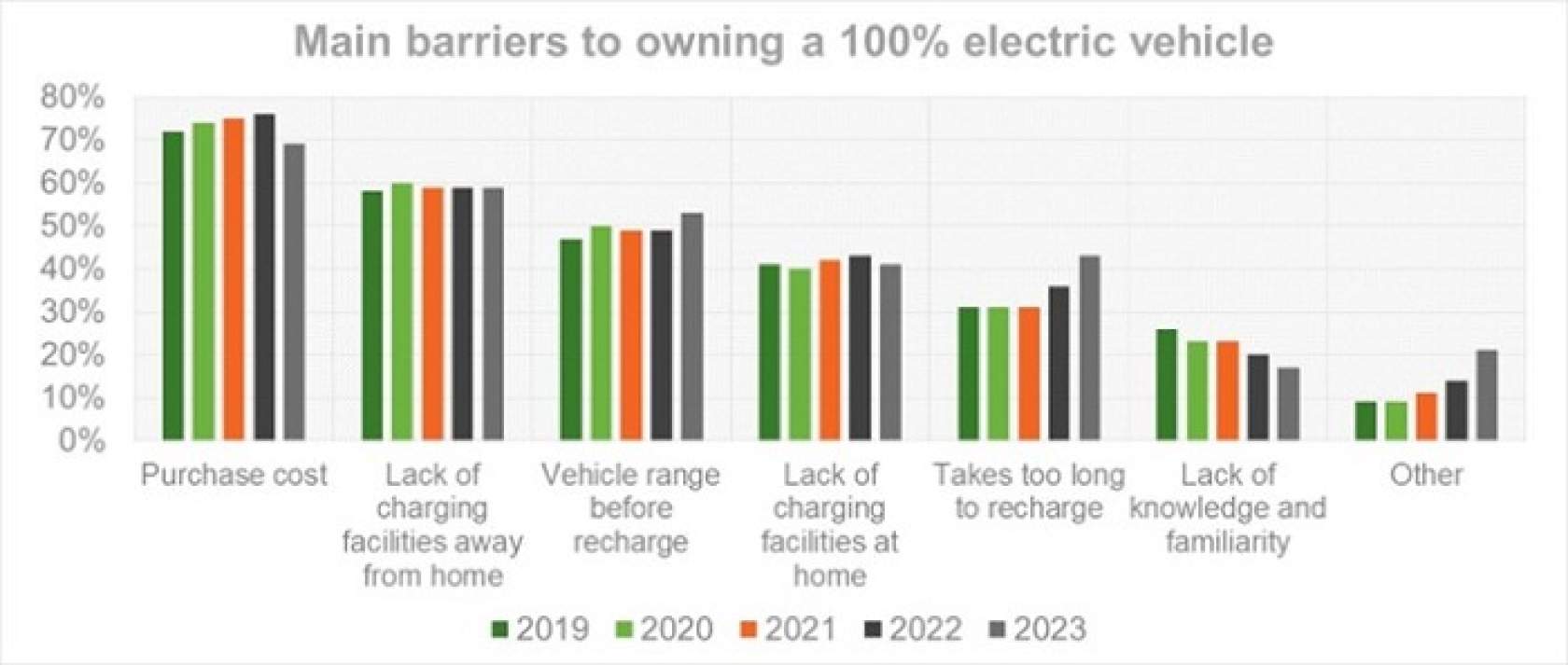

Cost and Infrastructure: Purchase cost is the top barrier (69%, down from 76% in the previous year), followed by lack of charging facilities away from home (59%, unchanged) and vehicle range concerns (53%, up from 49%).

Impact of Price Reductions: Recent price cuts and new, cheaper models are starting to address the cost barrier.

Government Incentives: Support for incentives has declined, with 55% of motorists in favour, compared to 69% and 74% in previous years. Preferred incentives include reductions in purchase price and annual registration costs.

Driver Assist Preferences

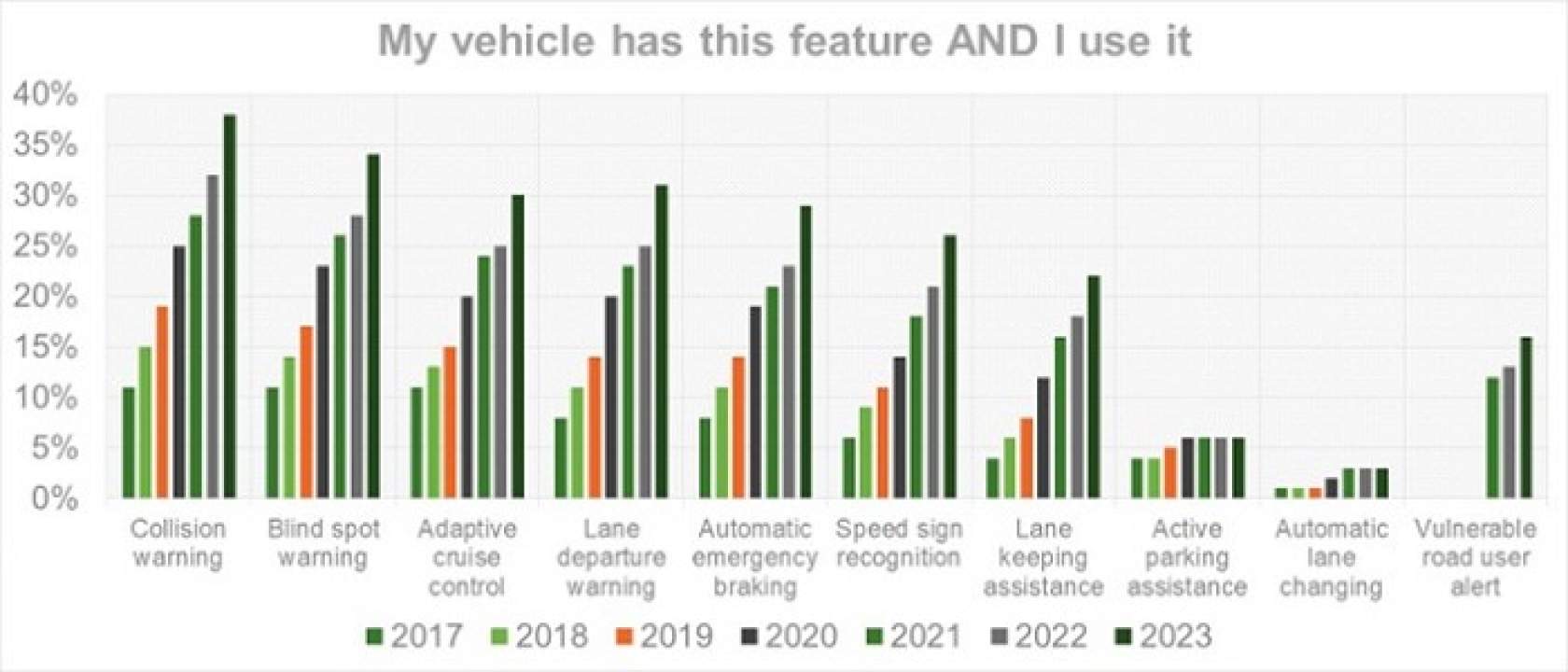

Driver Assist Functions: Usage of most driver assist technologies is increasing, except for active parking assistance and automatic lane changing. Adaptive cruise control and active parking assist are also underutilised compared to other functions. Desirability of most driver assist functions has declined slightly compared to the previous year, except for cruise control, which remained unchanged.

Knowledge and Perception of Self-Driving Technology

Self-Driving Knowledge: There’s been a shift of 5% of motorists from “very little knowledge” to “some knowledge” over the past two years. However, 46% still feel they have “no knowledge” or “very little knowledge” about self-driving vehicles.

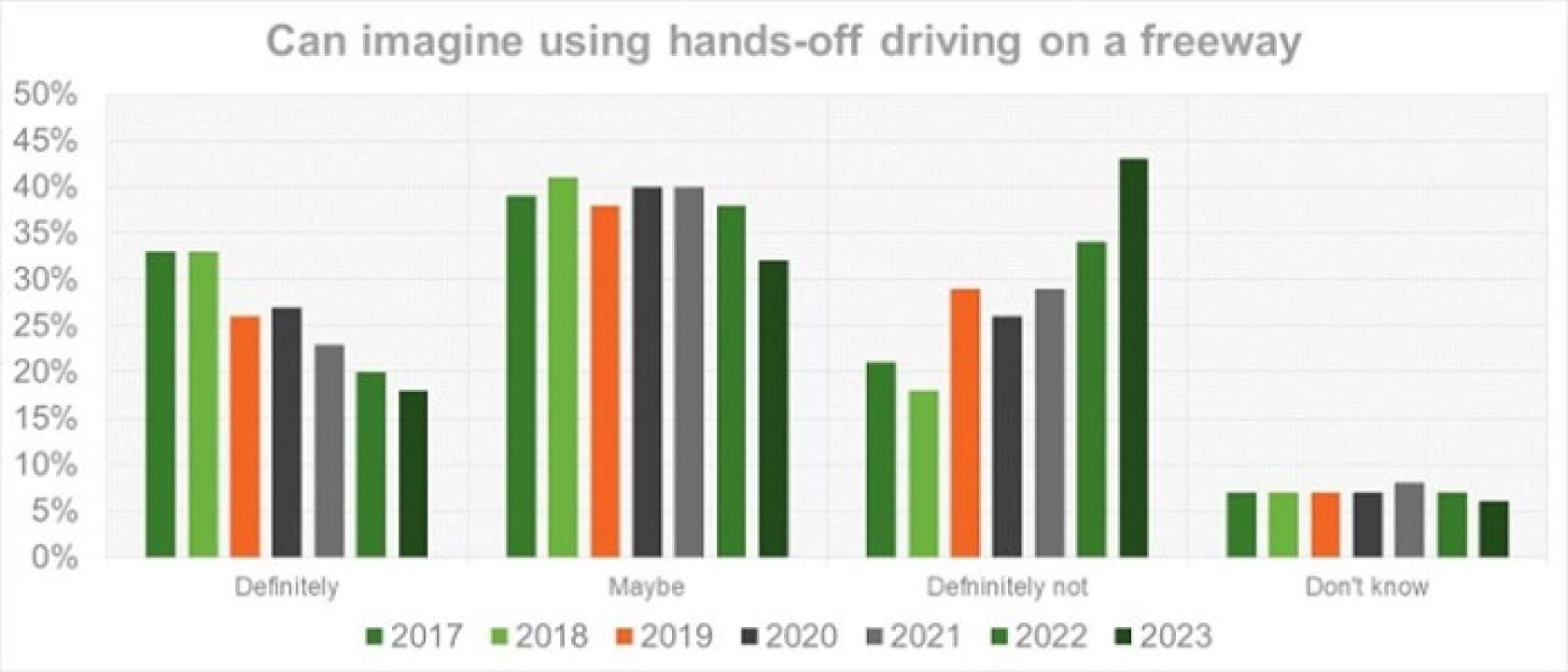

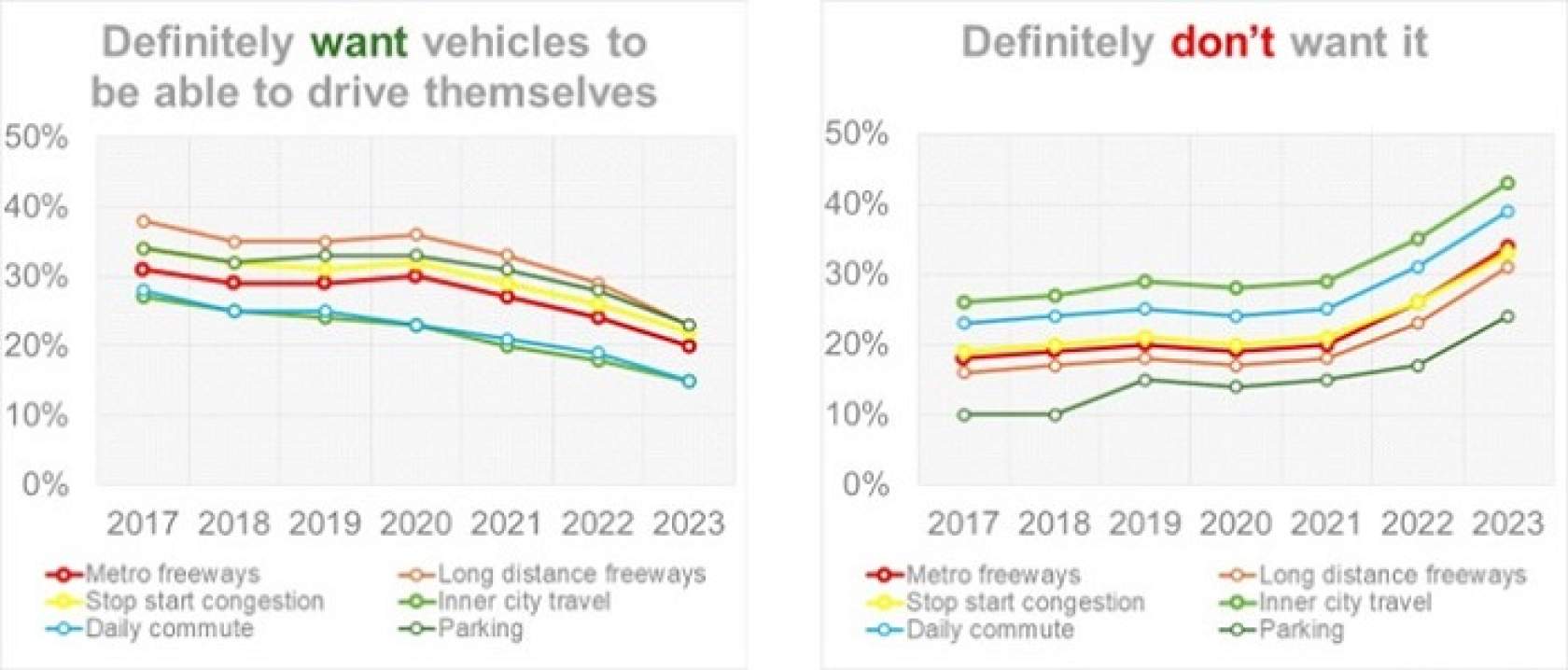

Hands-Off Driving on Freeways: Interest in using hands-off driving on freeways has declined. Only 18% can now "definitely" imagine it, while 43% "definitely cannot."

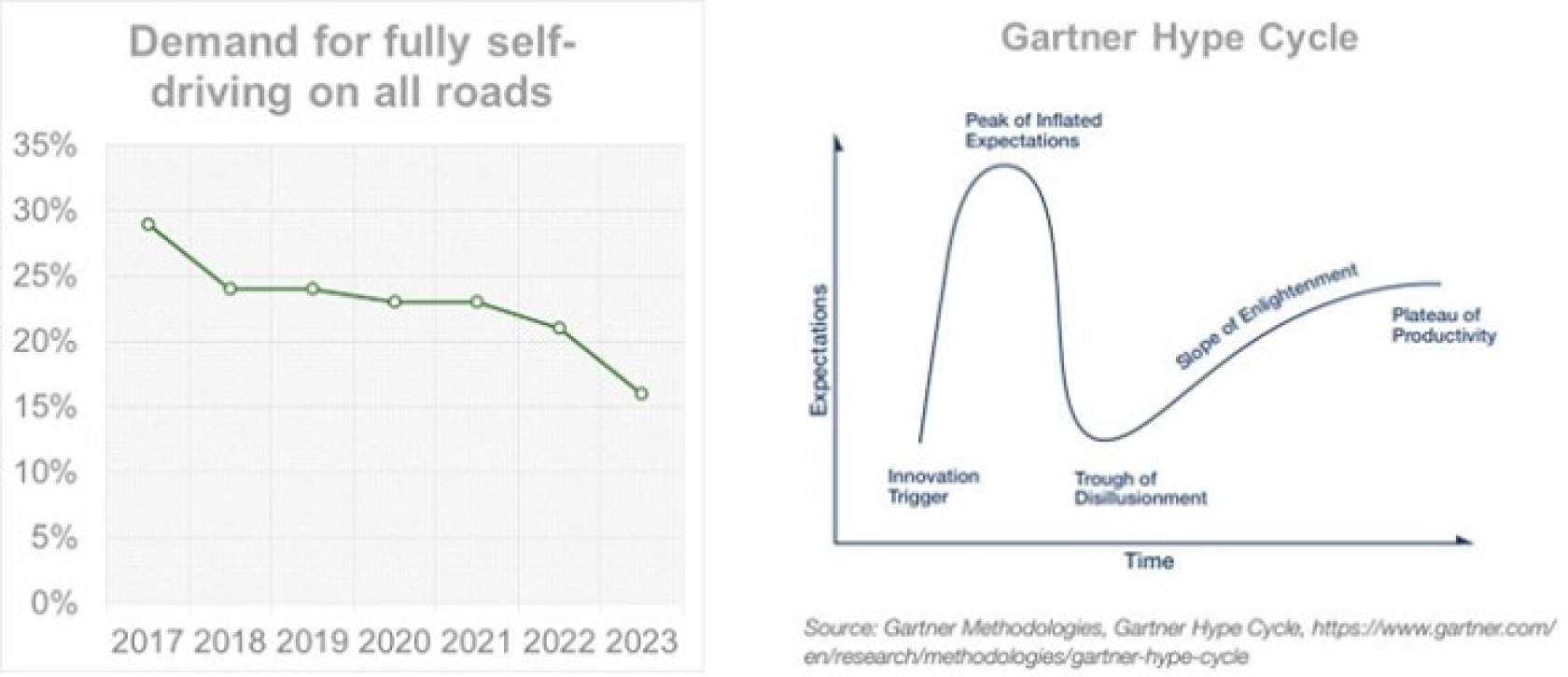

Fully Self-Driving Vehicles: Desire for fully self-driving vehicles across various journey types has decreased. Only 16% want their next vehicle to offer fully self-driving on all roads, down from 21% last year and 29% in 2017.

Gartner’s Hype Cycle: Motorists' expectations remain in Gartner’s “trough of disillusionment” regarding fully self-driving vehicles, characterized by missed expectations and growing disillusionment.

Passenger Comfort in Self-Driving Cars: Willingness to travel in fully self-driving cars has declined. While 60% would now travel in a car with a monitoring driver, only 21% would do so in a car with no driver and no controls.

Connectivity in Future Vehicles

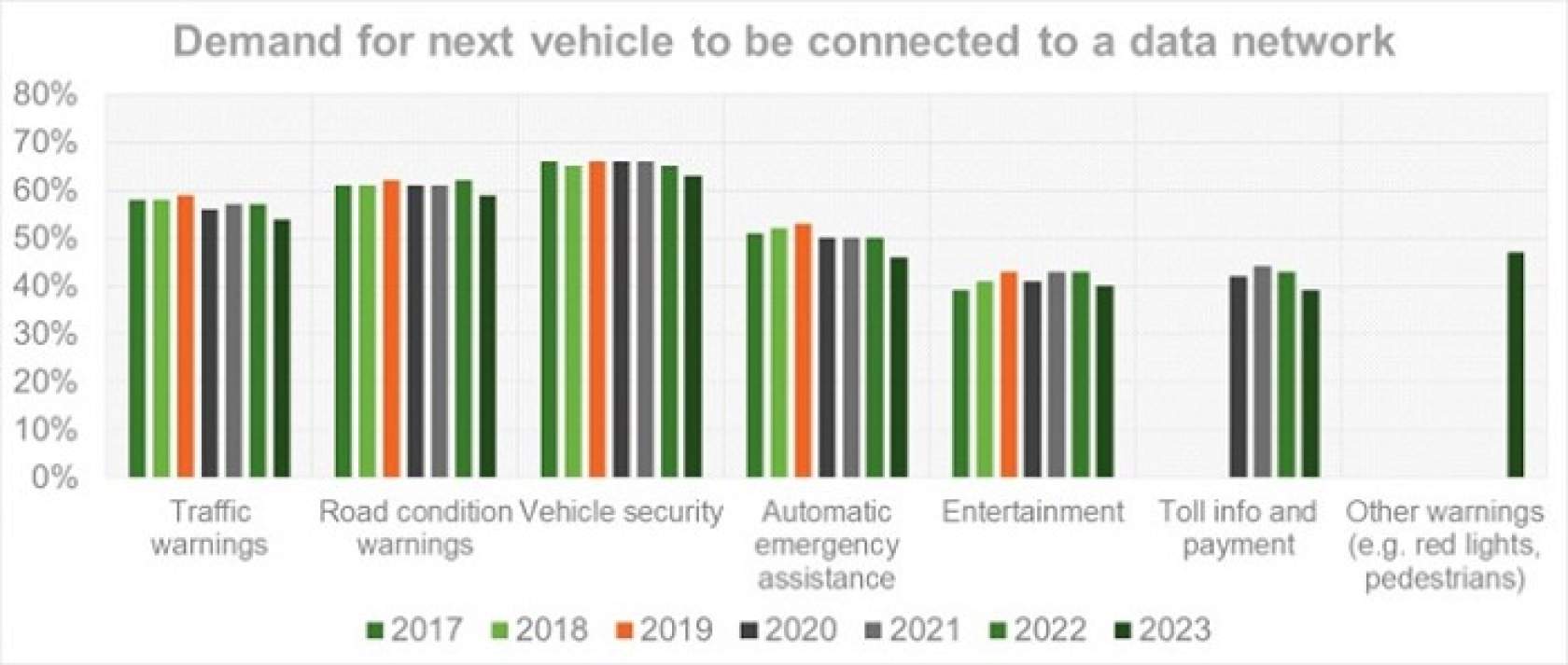

Data Network Connectivity: A majority of motorists want their next car connected to a data network for traffic warnings, road conditions, and vehicle security. 46% want connectivity for automatic emergency assistance, and 47% for other warnings (e.g. red lights, pedestrians). Demand for entertainment and toll information connectivity is also significant. However, demand for connectivity has decreased slightly compared to the previous year.

Conclusion

EastLink's annual survey highlights significant changes in motorist preferences, barriers, and perceptions regarding electric and self-driving vehicles. While hybrid vehicles gain popularity and fully electric vehicles see a decline in preference, barriers like cost, charging facilities away from home, and range anxiety remain critical. Motorists' enthusiasm for self-driving technology is waning, reflecting growing scepticism and disillusionment. As the industry evolves, addressing these concerns will be crucial for future adoption and acceptance of advanced vehicle technologies.

EastLink is a founding member of CCAT

EastLink is proud to be a founding member of CCAT (Centre for Connected and Automated Transport). As the findings show, there is still much to be done to bring the public along for the journey when it comes to self-driving technologies in particular. We support CCAT’s work as a champion in this space.

Electric vehicles

46% of motorists continue to include hybrid electric in their power preferences for their next vehicle.

However, 34% of motorists now include 100% electric in their power preferences, which is a significant drop compared with the previous two years (42%).

The preference for petrol has increased from 24% to 31%, and the preference for diesel has increased from 12% to 15%.

This is the first time in this annual survey that the preference for 100% electric has decreased, and the preferences for petrol and diesel have increased.

The main barriers to owning a 100% electric vehicle are: purchase cost (69%, down from 76% in the previous year), followed by the lack of charging facilities away from home (59%, no change), and then vehicle range before re-charging (53%, up from 49% in the previous year).

The recent price reductions for established electric vehicle models and the introduction of new models with even lower costs are clearly starting to having an impact on the purchase cost barrier.

Driver assist functions

More and more motorists each year are using the latest driver assist functions.

The exceptions are active parking assistance and automatic lane changing, which are not used much, and for which usage is not increasing.

Fully self-driving cars

Since 2017 there has been a significant, on-going decline in the number of motorists who say they could “definitely” imagine using hands-off driving on a freeway.

Over the same timeframe, there has been a larger increase in the number of motorists who say they could “definitely not” imagine it.

18% can now “definitely” imagine it, compared to 43% who can “definitely not” imagine it.

This is a huge swing compared to 2017, when 33% could “definitely” imagine it and only 21% could “definitely not” imagine it.

Since 2017 there has been a significant, on-going decline in the number of motorists who say they “definitely want” vehicles to be able to drive themselves across a wide range of journey types.

This decline has been matched by an increase in the number of motorists who say they “definitely don’t want” it, in particular over the last two years.

Compared to earlier years motorists are much less likely to want their next vehicle to offer fully self-driving on all roads. Only 16% of motorists now want it, compared to 21% in the previous year, and 29% back in 2017.

This, together with the other results in the survey outlined above, indicates that motorists’ expectations remain in Gartner’s “trough of disillusionment” when it comes to fully self-driving on all roads.

Gartner has explained its Hype Cycle “trough of disillusionment” as follows:

Impatience for results begins to replace the original excitement about potential value. Problems with performance, slower-than-expected adoption or a failure to deliver financial returns in the time anticipated all lead to missed expectations, and disillusionment sets in.

There has been an on-going decline in the number of motorists who would travel as a passenger in a fully self-driving car on a freeway where the vehicle has a driver who is monitoring and able to take over control.

There has also been an on-going decline in the number of motorists who would travel as a passenger in a fully self-driving car on a freeway where the vehicle has no driver and no driving controls.

While 60% would now travel in a fully self-driving car on a freeway where the vehicle has a driver who is monitoring and able to take over control, this falls to just 21% where the vehicle has no driver and no driving controls.

Connected cars

A majority of motorists “definitely want” their next car to be connected to a data network for traffic warnings, road condition warnings and vehicle security applications.

47% of motorists “definitely” want their next car to be connected to a data network for other warnings (e.g. red lights, pedestrians).

46% motorists “definitely want” their next car to be connected to a data network for automatic emergency assistance.

Four in ten motorists “definitely want” their next car to be connected to a data network for entertainment as well as toll information and toll payment.

While there continues to be a latent demand for future applications enabled through vehicle connectivity, the demand has decreased slightly in the most recent survey.